- Press Release -

Wiesbaden, 9 November 2011

The German Council of Economic Experts (Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung – GCEE) is today publishing its Annual Report 2011/12 with the title

Assume responsibility for Europe

As the year 2011 approaches its end, the German economy faces a number of severe risks. Most importantly, the sovereign debt crisis in the euro area, which was initially confined to Greece, has escalated into a vicious circle comprising a sovereign debt crisis intertwined with a banking crisis. The situation on the financial market is reminiscent of the dreadful experience of September 2008 that followed the collapse of Lehman Brothers. Even the comprehensive decisions taken at the euro summit of 26 October 2011 have so far not been able to calm financial markets, and today political uncertainties are as present as ever.

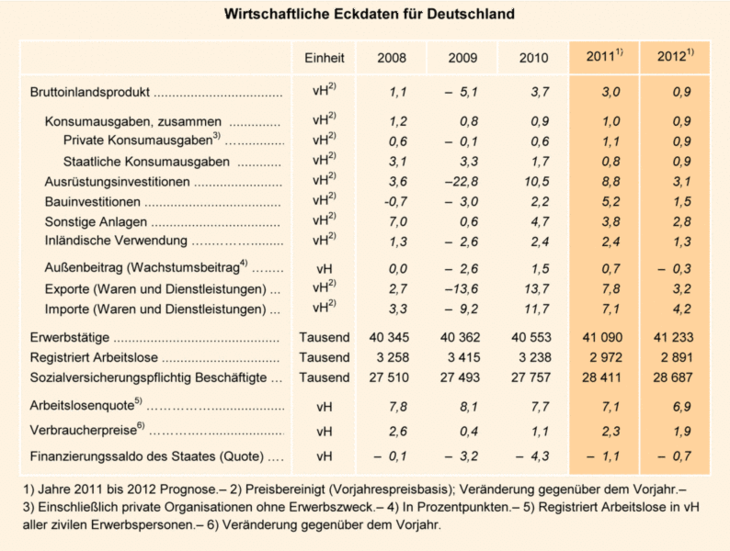

Despite these unfortunate developments in the euro area, the German economy seems to be remarkably robust. Even though the catch-up growth that followed the deep recession experienced in 2011 has slowed down considerably in the course of the current year, GDP is expected to increase at a rate of 3.0 % in 2011. Again, as in the preceding year 2010 domestic demand has been the strongest driver of growth. In the light of growing uncertainties surrounding the world economy and the growing pressure to consolidate public finances in most of the industrialised countries GDP is expected to grow at a rate of merely 0.9 % in 2012. As the risks of our forecast are very difficult to quantify precisely, the GCEE has calculated alternative scenarios for the growth in Germany's economic activitiy in the next year. The most unfavourable of these scenarios displays a slight decrease in GDP for the year 2012.

For several reasons Germany bears a particular responsibility in overcoming the euro crisis. The German government and the German parliament have addressed this challenge, in particular by supporting an enhancement of the possibilities for decisive action by the European Financial Stability Facility (EFSF). But a long-term stabilization of the Euro area is still to be achieved. Particular efforts need to be spent by those Euro area members currently facing liquidity problems, in form of serious fiscal consolidation and promising structural reforms. Unfortunately, there is a severe risk that these efforts will be undermined by a continuing lack of confidence among investors and, correspondingly, by high risk premia on the bonds markets.

If, and only if this undesirable scenario will prove to come true, the GCEE suggests that European leaders carefully scrutinize engaging in a European Redemption Pact. This arrangement of limited duration would combine credible road maps for the long-term consolidation and debt redemption in the Euro area with a joint backing of the refinancing of weaker European countries in the short term. Beyond the stabilization of the Euro area, the German government will have to address several other problems that require a European perspective: First, as desirable key reforms of the financial market architecture are still pending, they need to be resolutely advanced. Second, the objective of substituting nuclear power and fossil fuels in the system of energy provision requires both, that the support of renewable sources of energy and of the means for energy transport and storage are designed more efficiently than in the past, and that national energy policy adopts a genuinely European perspective. By providing strategic vision and political action at such a European scale, Germany would sincerely assume its particular responsibility.

German Council of Economic Experts

Federal Statistical Office of Germany

65180 Wiesbaden

Telephon: 0049-611-75-3640, Fax: 0049-611-75-2538

E-Mail: srw@destatis.de

Internet: www.sachverstaendigenrat-wirtschaft.de