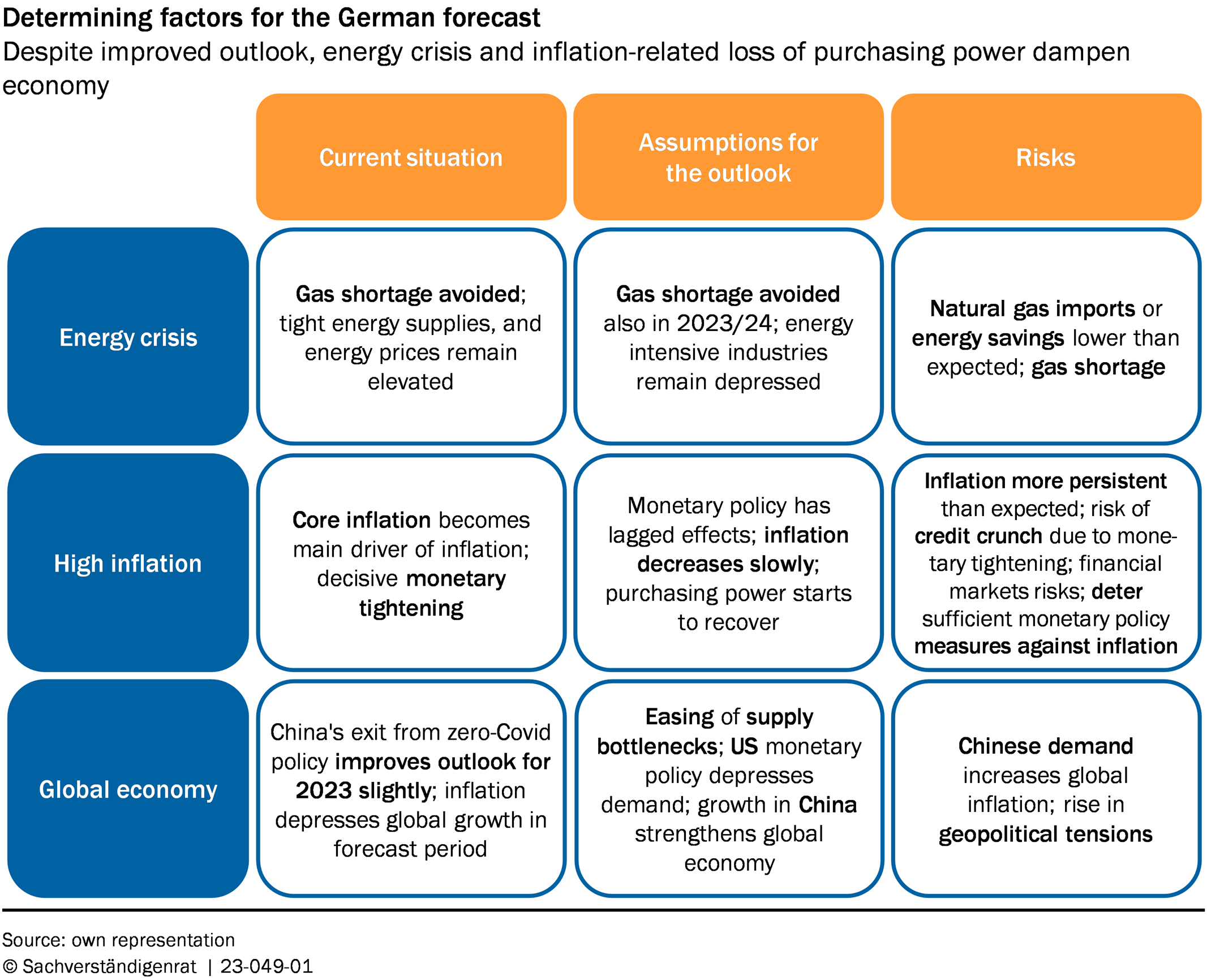

- The short-term outlook for the German economy has improved slightly as the supply of energy has become more stable and wholesale prices have declined.

- The still elevated inflation however reduces household’s purchasing power and dampens consumer demand. In addition, rising interest rates tighten financing conditions and lead to a decline in investment.

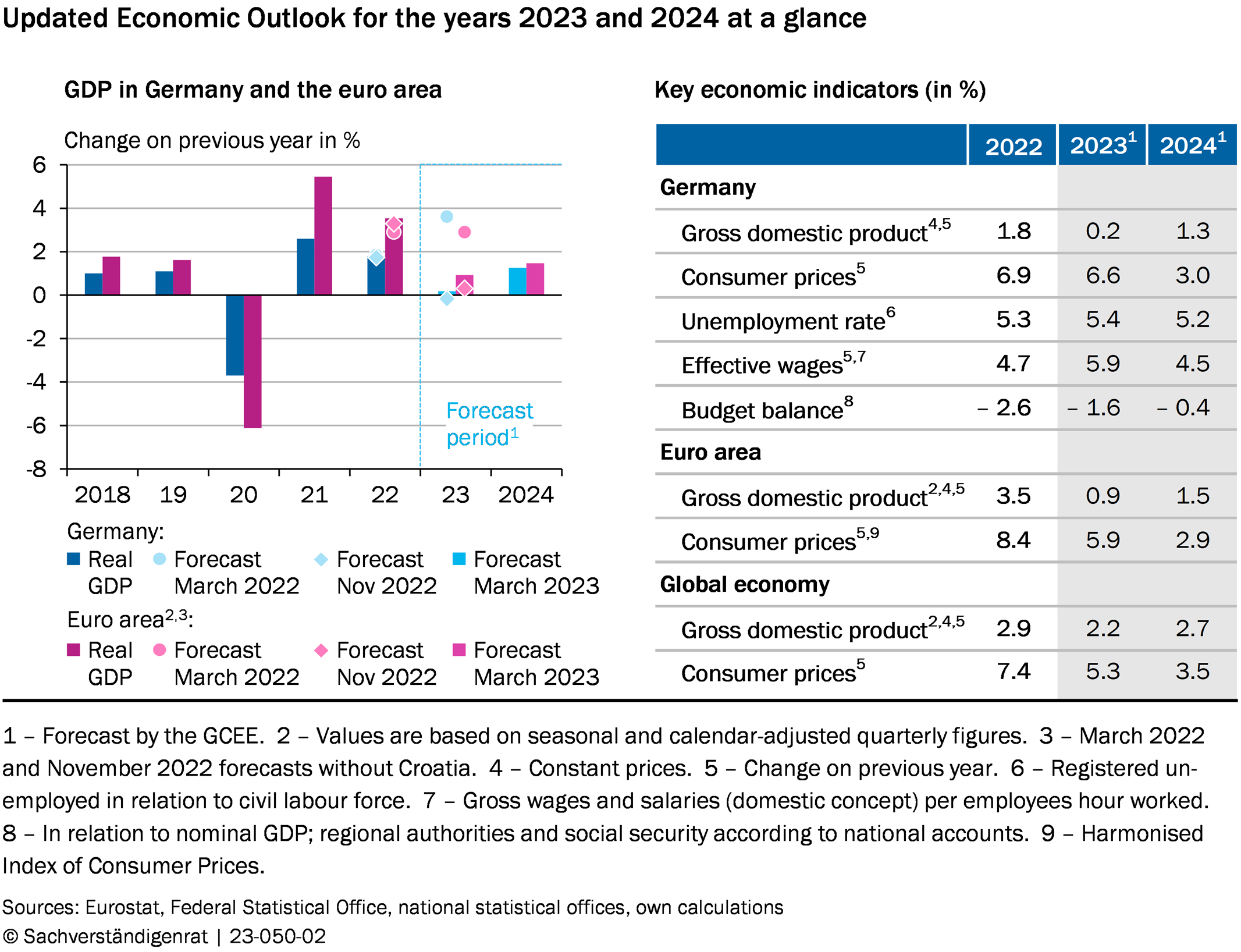

- The German Council of Economic Experts expects German GDP to grow by 0.2 per cent in 2023 and by 1.3 per cent in 2024.

- Inflation is expected to decline over the course of the year, but will still remain significantly elevated, averaging 6.6 per cent for 2023. For 2024, the GCEE expects an inflation rate of 3.0 per cent.

The short-term outlook for the German economy has improved slightly compared to autumn 2022, but the situation remains strained. High inflation continues to inhibit the economy this year. The German Council of Economic Experts (GCEE) expects gross domestic product (GDP) to grow by 0.2 per cent in 2023 and by 1.3 per cent in 2024. “The loss of purchasing power due to inflation, tighter financing conditions and the slow recovery of foreign demand prevent a stronger upswing this year and next,” says Monika Schnitzer, chair of the council.

According to the GCEE, inflation peaked in autumn 2022. However, it is still significantly elevated and is likely to decline only slowly. The GCEE expects an average inflation rate of 6.6 per cent in 2023. “Inflation is increasingly more broad based,” explains council member Martin Werding. “Higher producer prices and expected wage increases are likely to keep up consumer price inflation well into the next year.” Only in 2024 the inflation rate is likely to drop noticeably, when it is expected to decrease to 3.0 per cent.

In view of the high inflation, the European Central Bank (ECB) has begun to reduce its bond holdings and has raised key interest rates significantly. This tightens the financing conditions for households and companies, dampening both consumer demand and private investment. Tighter monetary policy will most likely affect inflation and noticeably slow down price increases later in the year.

“Inflation is still far above the ECB's target of two percent, suggesting the need for further interest rate hikes this year. However, the high level of uncertainty in financial markets in recent weeks has made it more difficult for central banks to counter inflation,” states council member Ulrike Malmendier.

Despite these economic challenges, the labour market performance in Germany is stable. Employment is projected to increase slightly until the end of 2024. The GCEE expects effective wages to increase significantly, by 5.9 and 4.5 per cent in 2023 and 2024, respectively. These increases reflect recent wage settlements and additional inflation compensation. “In 2023, wages are expected to grow less than inflation. Real wages are not expected to rise until next year. Only then, rising real wages are expected to stimulate private consumption,” says council member Achim Truger.

The outlook for public finances has improved noticeably. The expected expenditures for the energy price brakes, in particular, are significantly lower than assumed in autumn 2022. The GCEE expects the budget balance per GDP to be -1.6 per cent in 2023 and -0.4 per cent in 2024. The debt-to-GDP ratio is expected to fall from 67.4 per cent last year to 63.5 per cent next year.

Energy crisis is not over yet

Energy supply has stabilised for the moment, due to the mild winter of 2022/23 and the continued low demand for natural gas from East Asia. Accordingly, wholesale energy prices have fallen significantly. Overall, short-term downside risks for the German economy have decreased. For the winter of 2023/24, however, the risk of renewed price increases or even a gas shortage remains. The energy price brakes that have been in place since January limit potential cost surges for consumers. However, the lower energy prices are likely to weaken the incentive to save energy.

There are still considerable risks to energy supply in the coming winter. “The energy crisis is definitely not over. In order to fully replenish the gas storages and prevent a gas shortage in the coming winter, we must continue to save energy extensively. This applies even if we succeed in further expanding imports,” warns council member Veronika Grimm.

China's move away from its strict zero-covid policy could boost GDP growth. Chinese demand could increase and thus benefit German foreign trade. At the same time, there is a risk that increasing geopolitical tensions between the US and China will depress global trade.

Current situation on the financial markets

The uncertainty in financial markets has escalated in recent weeks due to the events leading to the closure of the Silicon Valley Bank and the takeover of Credit Suisse by UBS. In contrast to the situation during the global financial crisis, however, the problems of these individual banks do not reflect worthless financial products. Moreover, the interbank market and the credit supply to the economy are currently intact. Therefore, the GCEE does not see financial stability at risk as of now.