SETTING OUT FOR A NEW CLIMATE POLICY

Executive Summary

Click to share

(1) Germany finds itself in the midst of an intense debate about a realignment of climate policy and the possibilities and limits of reform options in this area. This debate has been triggered not least by protests among parts of the population in many countries about the lack of progress in combatting climate change. It is also being fuelled by the growing sense that it will be very difficult for this country to achieve the internationally agreed binding European targets for cutting greenhouse gas emissions. At the same time there have been protests in France against, among other things, the raising of environmental taxes. It is against this backdrop that the German government has asked the German Council of Economic Experts to compile a special report discussing the options for reforming climate policy.

Economic principles: effectiveness and efficiency

(2) Any climate policy that ignores economic considerations is ultimately doomed to failure. Effective protection against climate change requires a drastic reduction of global greenhouse gas emissions and, consequently, a comprehensive transformation of energy supply systems away from the fossil fuels that currently dominate. The Paris Climate Agreement has set the clear target of limiting global warming to well below two degrees. This is a monumental task that can only be achieved with the help of carefully targeted political measures and the use of considerable economic resources. Cost-effectiveness is therefore essential.

(3) This realignment of climate policy should obey the economic principle of the division of labour in order to minimise the economic cost of this transformation. The potential for the division of labour tends to grow as the number of actors involved increases. The guiding principle here is that greenhouse gas emissions can be reduced economically efficiently if the next unit is saved wherever this is the most cost-effective – irrespective of at what location, with which technology, in which industrial sector and by which polluter this is achieved. This principle therefore dictates that the lowest-hanging fruit – according to the technical possibilities available at the time – should be harvested first. Technological advances then enable further necessary savings to be achieved more cost-effectively over time.

(4) A number of different actors will determine the actual process of this transformation by making decisions – partly based on private information not available to outsiders – about their energy consumption and their investments. A coordination strategy guided by market-based principles thus plays a key role in achieving the goal of a cost-effective transformation. A uniform price on carbon dioxide (CO2) emissions would ensure that CO2 would never be emitted if its avoidance was cheaper than its price. The basic mechanism and the relevant conclusions also apply to all other greenhouse gas emissions such as methane and nitrous oxide. On the other hand, detailed targets – especially those set for individual sectors within economies – stand in the way of effective solutions. Moreover, it is questionable whether they are fundamentally suited to achieving the general climate objectives.

Global coordination essential in combatting climate change

(5) A globally coordinated, common approach is essential in order to contain global warming effectively and ensure economic cost-efficiency. Even if they were to eradicate all of their own greenhouse gas emissions, Germany and the European Union (EU) could only make a very modest direct contribution to containing global warming. CHART 1 Global coordination must therefore play a key role in Germany’s climate policy, and a movement towards a globally uniform pricing of greenhouse gas emissions must be initiated.

(6) The Paris Climate Agreement represents a first major step in setting common targets for the maximum temperature rise in an international treaty. The implementation and enforcement of this agreement will, however, require further efforts. A worldwide uniform price would provide the ideal signal for containing the global transformation costs and, at the same time, it would be the best instrument for effectively achieving and monitoring the worldwide coordination of efforts on climate policy. Once a corresponding global minimum price for greenhouse gas emissions was agreed, the specifics of implementation could be left to each region. A suitable option in this case would be, for example, an emissions trading scheme that covered all sectors and actors in a region, such as the one that could be created in the EU by extending the system that already exists there.

(7) In trying to persuade other countries around the world to adopt such uniform pricing, Germany and the EU will need to have the strongest possible negotiating position. When evaluating climate policy measures it is therefore necessary to consider their impact on this negotiating position:

- National measures to mitigate the consequences of climate change (adaptation), which – given the already advanced temperature rise and its impacts – will probably be needed anyway, would strengthen this negotiating position on the international stage.

- It will probably not be very helpful to aspire to a pioneering role which, by achieving a more ambitious reduction of greenhouse gas emissions, goes beyond what has been internationally agreed. Rather, the guiding principle of international negotiations on combatting climate change should be reciprocity.

- In contrast to performing such a pioneering role, acting as a role model could certainly be helpful. This would be the case, for example, if a highly developed economy such as Germany, which makes intensive use of fossil fuels, managed to achieve the internationally agreed targets efficiently and without causing major social disruption.

- Another key component of the global negotiating strategy might be additional financial incentives, especially given the need for development outside the industrialised nations and the considerable variations in avoidance costs worldwide. The willingness to introduce appropriate carbon pricing could, for example, be included in negotiations of free trade agreements or determine access to the financial resources of an enlarged international climate fund.

Consistent carbon pricing in Germany and the EU

(8) The transformation towards lifestyles and forms of production with fewer CO2 emissions will require new technologies to be developed. As can be empirically observed at present, innovations are one of the key factors that will enable poorer regions to catch up economically without creating the same level of CO2 emissions as the advanced economies have in the past. Achieving climate neutrality in the long term will, in all probability, require competitive technologies and investments that prevent newly generated CO2 from escaping into the atmosphere or remove from the atmosphere CO2 that has already escaped.

(9) A carbon price strengthens the incentive to invest in lower-emission machinery and equipment, encouraging suitable business models and the search for innovations. In order to complement this approach, the richer economies should step up their technology-neutral funding of (basic) research. Given the spillover effects and the economies of scale involved in this area, a coordinated approach at the European level would be beneficial.

(10) However, technological advances alone will not be sufficient to meet this climate policy challenge. In the long term, Germany and the EU will have to make their economies carbon-neutral. The key question is what is the best way to achieve this? Under the Paris Climate Agreement the EU has committed itself by 2030 to cutting greenhouse gas emissions by 40 % compared with their level in 1990.

- The EU aims to meet this target partly by reducing the quantity of certificates available in its emissions trading scheme (EU ETS). This system currently covers the energy and industrial sectors, which account for roughly 45 % of emissions. The way in which the EU ETS is constructed means that its emissions reduction target is bound to be achieved.

- The member states have also agreed emissions reduction targets for the sectors outside the EU ETS. These targets relate to the transport, buildings and agriculture sectors in particular.

(11) The targets set at European level effectively make additional national limits redundant – both for the economy as a whole and especially for individual sectors. Nonetheless, Germany has set itself a number of national targets for cutting greenhouse gas emissions. Its expensive environmental projects, the support provided by the German Renewable Energy Sources Act (EEG) and the phase-out of fossil fuels (Kohleausstieg) all relate to areas that are already covered by the EU ETS and – without any appropriate accompanying measures – would not help to further reduce EU-wide emissions. From a climate policy perspective these measures are therefore questionable.

(12) The measures that Germany has implemented in the sectors not covered by the EU ETS have so far consisted of a variety of fragmented targets and action plans as well as taxes and levies that are inconsistent from a climate policy perspective. Germany – in common with other member states – is at risk of failing to hit the targets set for 2020 and 2030 in this area. This violation could impose considerable fiscal costs on Germany or even result in it facing an infringement procedure. Given this situation, the question is what reform options Germany and Europe should be pursuing as a matter of priority.

(13) Since a uniform price would minimise the macroeconomic costs of reducing emissions within the EU, the division between EU ETS and non-EU ETS emissions is not in line with the principle of the division of labour. To follow this principle, extending the EU ETS to all sectors in all member states should be the primary objective of EU climate-policy efforts. What is important is a credible medium- to long-term price signal that creates incentives for emissions reduction and suitable investments.

(14) A uniform pricing of CO2 emissions would also be an important element of the European internal market. Germany should work towards an agreement between all member states about an expansion of the EU ETS. As part of the persuasion process, Germany could hold out the prospect of additional funds via the EU Structural Fund. Should it prove difficult to reach a comprehensive agreement involving all member states, Germany could, together with other member states, integrate the non-EU ETS sectors into the EU ETS under the opt-in arrangements already provided for by EU regulations.

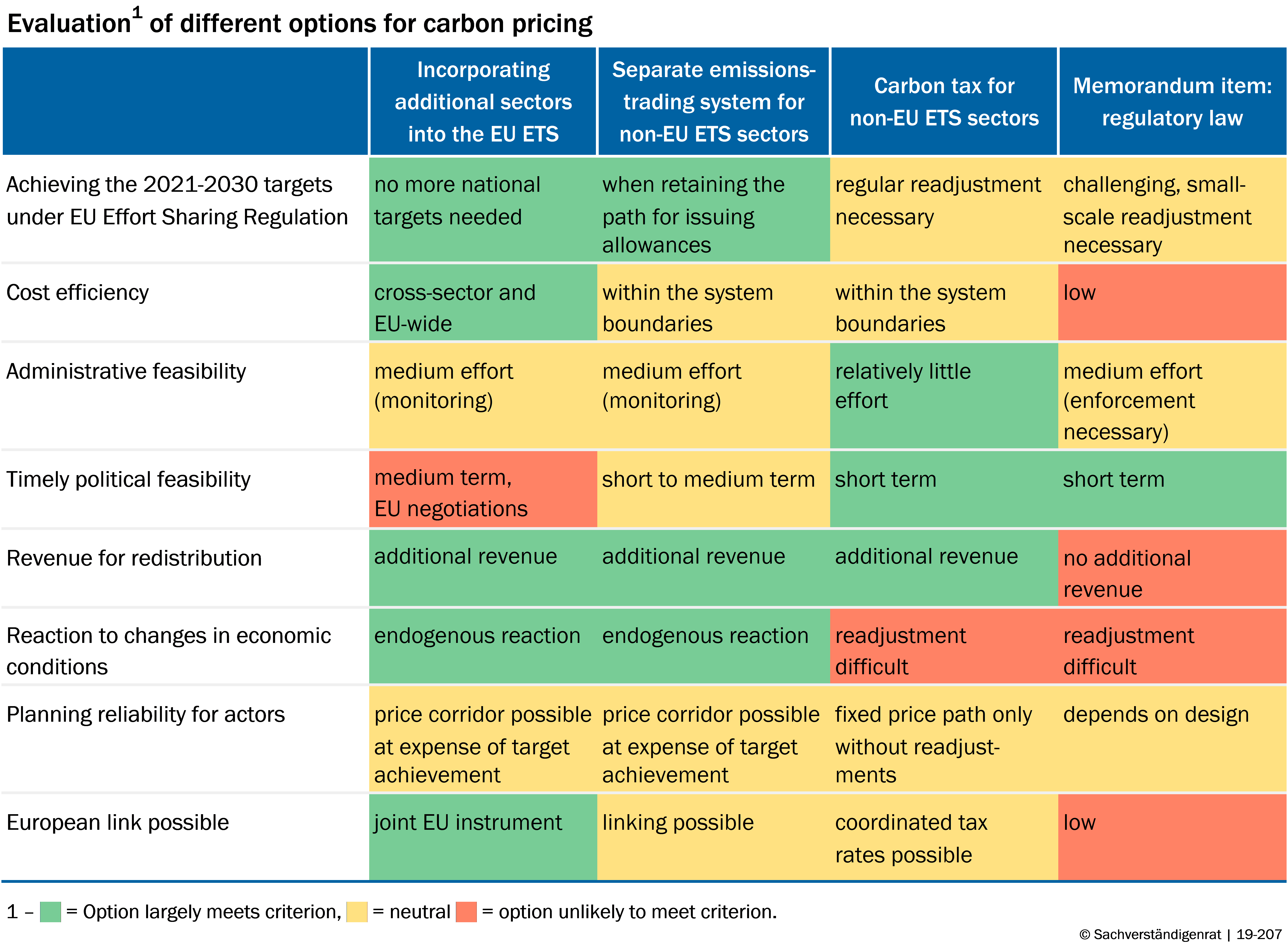

(15) An extension of the EU ETS or an opt-in should take place as quickly as possible, although it could involve lengthy legal and political procedures. In order to still efficiently reach the targets allocated to Germany for the non-EU ETS sectors in the short term, a separate pricing scheme for the non-EU ETS sectors is therefore necessary as a transitional solution. Options that would allow this in the short term are separate emissions trading for these sectors or a carbon tax. Table 1 The solution chosen for the transition should also be implemented by a coalition of as many member states as possible. Both solutions are still superior to a national regulatory or subsidised approach for achieving the objectives for the non-ETS sector in terms of cost efficiency, even if they are only implemented at the national level. Advantages and disadvantages must be considered when weighing up these options:

- Separate emissions trading can directly ensure that the quantitative target is reached. In the case of a carbon tax, this would require a regular adjustment of tax rates, which could undermine the credibility of political action from the point of view of its reliability. In emissions trading, on the other hand, the price results from the fixed development of the number of allowances.

- The carbon tax is administratively simpler and quicker to implement.

- Separate emissions trading should be easier to transfer into the existing EU ETS. Moreover, the price would react endogenously to economic fluctuations.

- A minimum price could be introduced in the emissions trading system to increase security for investors. Since the prices could prove to be considerably higher than initially thought, so that the political decision-makers might feel forced to intervene, a maximum price should be considered. In such a case, however, achievement of the objectives would no longer be guaranteed.

Ensuring competitiveness and social balance

(16) In view of the probably higher avoidance costs outside the EU ETS, the extension of the EU ETS to further sectors can be expected to lead to an increase in the price of CO2 emissions. This also affects the actors already in the EU ETS and increases their production costs. While there is little risk of companies transferring carbon-intensive operations abroad (carbon leakage) in the buildings and transport sectors, it is relevant in the sectors already covered by the EU ETS.

- The EU ETS has sophisticated systems for the free allocation of allowances to highly energy-intensive, internationally competitive production sectors, and a benchmarking system that reduces the absolute burden – and thus the risk of carbon leakage – while still offering incentives to reduce emissions.

- Furthermore, under state-aid law the member states have the option of compensating electricity-intensive companies for indirect carbon-emission costs.

(17) If the existing protection against carbon leakage based on the free allocation of allowances cannot, as up to now, avoid considerable competitive disadvantages, a border adjustment could be jointly considered with the other EU member states. A border adjustment, which should not be confused with the introduction of customs duties, would, however, involve a lot of administrative work and has the potential to cause trade-policy conflict.

(18) A price for CO2 emissions creates incentives for companies and households to emit less CO2 by acting appropriately and investing in equipment and consumer goods. If the EU's targets are to be met, households in particular will either have to react more strongly to price changes, or the price of CO2 emissions will have to be much higher. In order to intensify the adjustments following the existing incentives and thus to contain the necessary carbon price, targeted accompanying measures should therefore be considered.

- Subsidies for the purchase of low-emission equipment could be necessary, for example in the form of premiums for the replacement of heating systems. In the housing sector, it must be ensured that landlords have incentives to invest in their rental properties.

- Infrastructure investment is also required, for example in local public transport, or in the grid and storage infrastructure.

- Finally, the tax system could be fundamentally overhauled, thus increasing incentives to reduce CO2 emissions. This would affect, for example, the motor vehicle tax and the electricity tax and could include a redesigned road toll to finance the infrastructure.

(19) The primary aim of pricing CO2 emissions is to efficiently reduce them, not to generate additional tax revenue. In order to increase the level of acceptance of carbon pricing among the population, the resulting revenues should be redistributed in a socially balanced manner. Whether people pay more or less tax will depend on their carbon consumption: Chart 2

- A flat-rate reimbursement per inhabitant would on average relieve households up to the fifth income decile. However, the net effect would be heterogeneous within the income groups. A carbon-intensive heating system and a large living area are important factors that lead to high CO2 emissions. In addition, singles would pay more. If the per-capita lump-sum payout were reduced as the household size increases, the share of households with proportionately higher bills could be reduced. On the other hand, a distinction between urban and rural areas would have a lesser effect.

- A reduction in electricity costs by cutting electricity tax or financing the EEG reallocation charge from federal funds would not only mitigate the regressive effect of pricing, but also have a strengthening effect on sector coupling. This option would also be easier to implement.

- A reduction in direct taxes or social security contributions could reduce the burden on labour. This could lead to positive effects on production and employment. Such a measure would benefit only part of the population directly, but could be accompanied by other redistribution options.

- The German transfer system already has many ways of easing hardship by means of existing mechanisms. For example, the state pays the actual heating expenses for recipients of basic security benefits (SGB II) and income support (Wohngeld). Should additional interventions become necessary, the housing allowance could be adjusted.

Conclusions

(20) The current debate offers a historic opportunity to change German climate policy from a detailed, expensive and inefficient approach to a system centred around the pricing of greenhouse-gas emissions. A global approach is indispensable in order to curb global warming, and a newly designed climate policy can be a valuable building block in this context. But even if this were not to succeed in the medium term, this conversion would still enable Germany to achieve emission reductions at lower costs. Europe and Germany can only serve as role models if emission reductions can be combined with growing prosperity and social acceptance.

Your browser is outdated

Please update your Browser to view this website properly.

You will need at least Internet Explorer 11 to see our interactive charts.

Mozilla Firefox or alternatively Google Chrome will provide the best experience for this website. Update your browser now

![[Translate to english:] [Translate to english:]](/fileadmin/_processed_/4/6/csm_Header_klein_Bild_option4_55d362c03d.jpg)