- Inflation in the euro area has reached its highest level since European Monetary Union was first established.

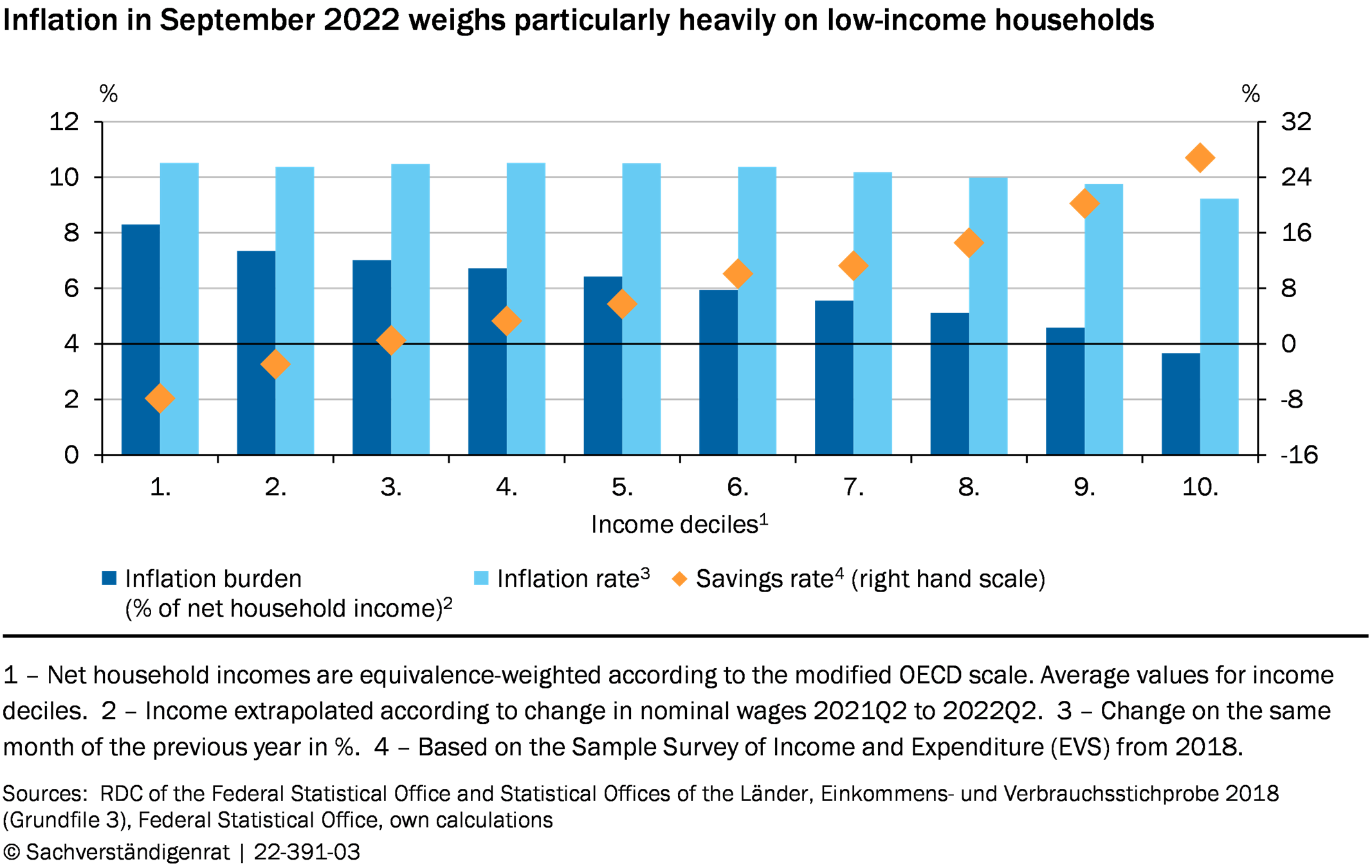

- Poorer households carry a heavier burden and have less financial leeway.

- A decisive response by the European Central Bank continues to be necessary.

For the euro area, the German Council of Economic Experts expects an inflation rate of 8.5 % on average in 2022, reaching its highest level since the European Monetary Union was first established. At the beginning of 2022, inflation largely reflected rising energy prices and supply bottlenecks. Since then, prices have been rising across the board.

High inflation rates dampen economic growth and can have a negative impact on the labour market. They can also adversely affect companies' financing and investment decisions. The European Central Bank (ECB) must continue to act decisively to ensure price stability and maintain its credibility. The challenge will be to raise interest rates adequately to fight inflation effectively without causing an excessive slump in economic activity. An overly strong reaction over a very short period of time could have a negative impact on the economies in Europe and increase the risk of a deeper recession. Too weak or too slow a reaction could put the ECB in the position of having to react all the more strongly later on, which would weigh even more heavily on economic growth and employment.

Different households are affected quite differently by inflation. Poorer households, for example, have to limit their consumption more strongly as they spend a larger share of their net income on energy and food, which have become particularly expensive. Therefore, relief measures should focus on low- and medium-income households. However, it is key to maintain incentives to save energy and not to weaken the scarcity signal of high energy prices.

"National fiscal policy needs to support rather than counteract the ECB's efforts to curb inflation," says council member Ulrike Malmendier. Relief measures that raise disposable income across the board increase demand, which in turn can fuel inflation. Therefore, relief measures should be targeted as best as possible in order to keep the inflation-increasing effect low.