- The energy crisis exacerbates the tensions between debt sustainability and the fulfilment of public tasks in EU member states.

- A binding expenditure rule would make EU fiscal rules more verifiable, limit sustainability risks and stabilise the economy.

- Appropriate reforms of the European Economic and Monetary Union would make it possible to finance joint European projects.

The energy crisis exacerbates the tensions between debt sustainability and the need for public spending in EU member states. Public debt had already risen sharply in virtually all member states due to the coronavirus pandemic, when additional relief measures were added to counteract the energy crisis. In order to ensure both the sustainability of public debt finances and the fulfilment of public tasks, a reform of the European Economic and Monetary Union is necessary. Public finances have to remain sustainable in the medium term, but too much consolidation can impair growth.

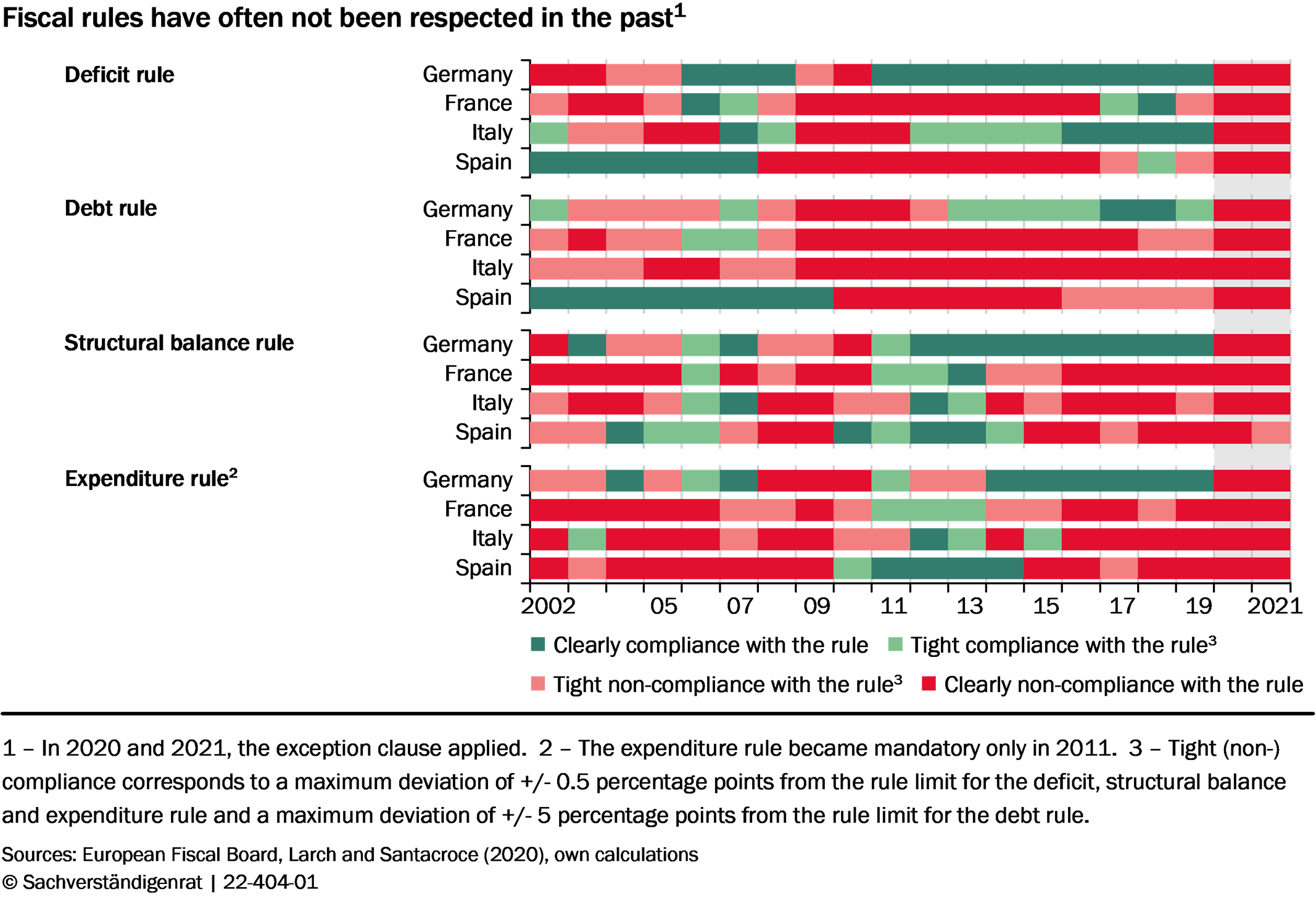

Even before the coronavirus pandemic, many EU member states had failed to effectively limit debt ratios, violating existing fiscal rules. The upcoming reform of the EU fiscal rules should focus on a binding expenditure rule and reduce the overall complexity of the rulebook. "A binding expenditure rule makes the EU fiscal rules more transparent and verifiable," says council member Achim Truger. "An expenditure rule is beneficial because it has a cyclically stabilising effect and can set incentives for future-oriented government spending."

A European fiscal capacity could provide additional EU funding for common tasks that generate European value added. For example, research funding or the expansion of the integrated European energy market are of a common European interest. Additional funds could be generated through higher national contributions to the EU budget or through own EU revenues. The reform of the economic and monetary union should also aim at strengthening financial market stability. To this end, the banking and capital market union should be advanced and the risks of government bonds in bank balance sheets need to be limited.